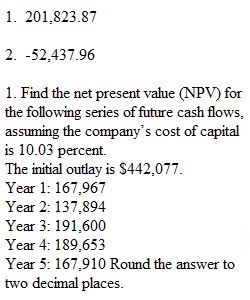

Q 1. Find the net present value (NPV) for the following series of future cash flows, assuming the company’s cost of capital is 10.03 percent. The initial outlay is $442,077. Year 1: 167,967 Year 2: 137,894 Year 3: 191,600 Year 4: 189,653 Year 5: 167,910 Round the answer to two decimal places. 2.Tall Trees, Inc. is using the net present value (NPV) when evaluating projects. You have to find the NPV for the company’s project, assuming the company’s cost of capital is 14.29 percent. The initial outlay for the project is $417,821. The project will produce the following after-tax cash inflows of Year 1: 149,357 Year 2: 15,165 Year 3: 160,931 Year 4: 196,712 Round the answer to two decimal places. 3.Green Landscaping, Inc. is using net present value (NPV) when evaluating projects. Green Landscaping’s cost of capital is 12.20 percent. What is the NPV of a project if the initial costs are $2,364,062 and the project life is estimated as 12 years? The project will produce the same after-tax cash inflows of $478,225 per year at the end of the year. Round the answer to two decimal places. 4.A project has an initial outlay of $3,729. It has a single payoff at the end of year 3 of $9,168. What is the net present value (NPV) of the project if the company’s cost of capital is 11.43 percent? Round the answer to two decimal places.

View Related Questions